I don’t normally harp. Ok, yes I do…. constantly... Just not in writing. Today I’m changing that up. The past couple of weeks helping customers complete their year-end FEC filing had me noticing something.

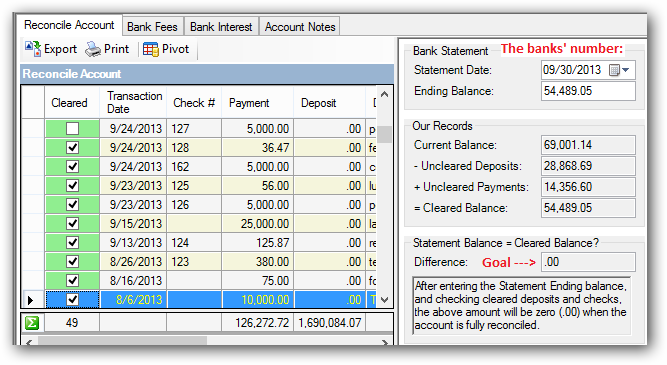

Many of our customers do NOT reconcile their Trail Blazer accounting with their bank accounts and then ensure that balance reconciles with what’s being reported to their campaign finance authority.

I’ve had a few folks say they reconcile with Quickbooks. Great! But…. Quickbooks does not do your FEC filing. On many occasions I have found missing transactions in Trail Blazer even though their Quickbooks accounts were reconciled.

Some do reconcile, but don’t ensure that the bank numbers are then reconciled to what is being reported to their campaign finance authority. Again, too frequently, I have see an unexplained difference between the reconciled bank balance and the reported number.

Why reconcile? You cannot know if you have captured all on your contributions and payments unless you are reconciling. Reconciling increases your confidence that what you are reporting is much more accurate. Reconciling on a timely basis ensures your books do not get out of control.

Interestingly I don’t get enough requests from customers asking for training on how to do the reconciliations. Training IS INCLUDED with your subscription. Take a look at the curriculums page.